Home » Company Registration in Bangalore – Quick & Reliable

Company Registration in Bangalore - How to Register?

We Make Business Registration : Quick, Affordable & Expert-Guided

Starting a business involves legal responsibilities. We handle company registration, GST, trade licenses, and NGO registration so your business stays compliant, penalty-free, and ready to grow.

Register Your Business in Bangalore | All You Should Know Before New Company Registration

Starting a company in Bangalore is sensible due to its tech sector and business-friendly environment. Formalities exist for business startups where company registration in Bangalore serves as the beginning step.

The registration process requires extensive effort because numerous documents exist alongside multiple legal requirements. Still, it provides your company with a legitimate identity and legitimacy. That simplifies banking, expands payment options, and builds client confidence.

Creating a business, developing one, or creating a company requires a fast and reliable registration procedure. Now is the time for expert aid. Company registration in Bangalore is simple if you know how to do it. This saves time, prevents mistakes, and prepares your firm for success.

Why You Should Register Business in Bangalore?

Starting a Bangalore company brings you into a vibrant city with lots of possibilities and assistance. Dubbed the “Silicon Valley of India,” Bangalore draws big companies, startups, and businesspeople from all over.

Starting a consultancy company, a software startup, or a retail business here provides access to a vibrant environment. Registered enterprises earn partner, buyer, and investor trust. Bangalore is the most excellent environment to legally, smoothly, and smartly execute your goals. This is made easier with company formation services in Bangalore.

We handle the legalities, making sure your business is legally compliant and future-ready. From company registration to trade licenses or GST registration, we make it hassle-free, eliminating delays and confusion. If you’re a startup, a growing business, or an NGO in Bangalore, here’s why business registration in Bangalore and tax and legal compliance is important:

- Limit your personal financial risk by keeping your business liabilities separate.

- Access government schemes, tax breaks, and support available for MSMEs.

- Gain trust and reputation, making it easier to get funding and form partnerships.

- Make running your business simpler with clear rules for taxes and legal matters.

- Stay on the right side of the law by following the necessary regulations and rules.

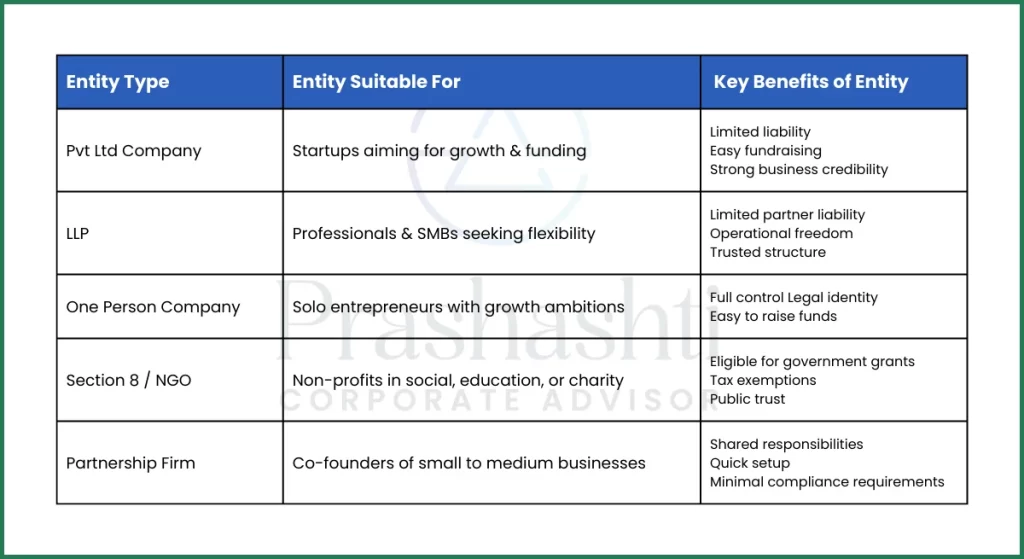

Types of Legal Business Structures You Can Register in Bangalore

Private Limited Company Registration (Pvt Ltd)

Private Limited Companies are ideal for new and developing enterprises. They protect owners from limited responsibility, simplify funding, and improve business image. This setup may benefit entrepreneurs who wish to build rapidly, recruit partners, and segregate their personal and corporate assets.

LLP Registration

LLP registration is ideal for businesses that desire partnership independence but wish to restrict partner responsibility. It works well for small to medium-sized organizations, professional firms, and new corporations. LLP registration is best if you want operating flexibility, personal asset protection, and a trustworthy reputation for your firm

One Person Company (OPC) Registration

One Person Company (OPC) registration is ideal for solo entrepreneurs who seek complete control and little risk. It is suitable for small business owners who wish to expand without partners. OPC is perfect if you desire a separate legal identity, simple fundraising, and strong brand recognition while operating alone.

Section 8/NGO Registration

Section 8 company registration in Bangalore is ideal for non-profit organizations that operate in social help, education, philanthropy, or the environment.

It helps people legally receive government funding, gifts, and aid. Section 8 registration is beneficial for helping community members and developing trust and openness.

Partnership Firm Registration

Partner firm registration is appropriate for two or more persons who wish to run a business and share earnings and tasks. It works well for small- to medium-sized enterprises that have few decisions and simple duties.

A partnership company is a simple and inexpensive method to launch a business with others.

Top Benefits of Company Registration in Bangalore

Starting a business in Bangalore offers several advantages that will set you apart. Why establishing your company here is a smart idea:

1. Access to a Huge Talent Pool

Many experts in every discipline reside and work in Bangalore. You may hire IT, ad, or finance professionals to expand your firm.

2. Strong Investor Network

Because they need fresh firms to fund, investors and venture capitalists flock to the city. List your company in Bangalore for better visibility and finance.

3. Business-Friendly Environment

Startup centers, networking events, and government policies that help new enterprises develop make Bangalore a wonderful business location.

4. International Recognition

Bangalore-based brands are more trustworthy. Companies worldwide recognize Bangalore as a hub for fresh ideas and exceptional services.

5. Vibrant Startup Ecosystem

Bangalore’s startup scene offers training, competitions, and shared workspaces to help your company expand faster.

Eligibility Factors to Register Company in Bangalore

Start your company in Bangalore with these essentials. Let us review the essential eligibility requirements:

1. Minimum Number of Directors or Partners

Depending on its kind, your firm needs one or two owners or partners. A private limited company needs two members.

2. Registered Office Address

A Bangalore address is required for business mail. It must be trackable, whether private or corporate.

3. Valid Identity and Address Proofs

Shareholders, partners, along directors need to prove their identity and domicile through PAN, Aadhaar, passport, or voter ID issued by the Indian government.

4. Digital Signature Certificate (DSC)

At least one director or partner must obtain a Digital Signature Certificate to file documents electronically with the Ministry of Corporate Affairs.

5. Director Identification Number (DIN)

Before starting a company in India, directors need a DNI

Step By Step Legal Process for Company Incorporation in Bangalore

The excitement of starting a business in Bangalore requires proper compliance with rules to prevent difficulties. The essential procedures for flawless registration are easy to recall

1. Decide the Business Structure

Start with what sort of company you wish to set up. Your business goals, investment plans, and the number of personnel will determine your pick.

A private limited company, LLP, a one-person company, or a partnership are all options. The correct organization impacts your legal obligations, taxes, and compliance tasks. I you are unsure, get consultation from our expert business registration consultants in Bangalore.

2. Apply for a Digital Signature Certificate (DSC)

Members and verified witnesses require a Digital Signature Certificate for online company registration in Bangalore. Sign government forms and documents safely with DSC as your online signature. Any approved organization, Advocates, Chartered Accountants, Company Secretaries, or Business Registration Consultants may assist you in applying for a DSC, which is quick.

3. Obtain Director Identification Number (DIN)

After earning the DSC, everyone who wants to be a company director needs a DIN. Director information at the Ministry of Corporate Affairs (MCA) requires a DIN number.

To start a company and apply for a DIN, fill out the Spice+ form. The method is simpler and faster.

4. Reserve Your Company Name

Choosing a company name is thrilling! Your name should be unique from other businesses or brands. Use the MCA website’s RUN (Reserve Unique Name) program to reserve a name. It will take 15-20 days to accept the name. You should move fast to the following stages.

5. Draft the MOA and AOA

The MOA and AOA are the most crucial documents that outline your company’s goals, policies, and operations.

The MOA describes the company’s actions, whereas the AOA describes its internal operations. You must be attentive while preparing this paperwork since it will govern your firm.

6. File the Incorporation Application (SPICe+ Form)

The MCA’s clever web-based SPICe+ form reserves names and assigns DINs, PANs, TANs, and company applications. Please complete this form carefully, attach any necessary documents, and submit it with your DSC. This is the most crucial step in registration.

7. Pay the Required Government Fees

You must pay government registration costs when you file the incorporation paperwork. The charge will depend on how much permitted cash your company has. Payment on the MCA website is simple and fast.

8. Verification and Approval by MCA

After receiving all papers and fees, the Ministry of Corporate Affairs will review your application. If everything checks out, they will issue a Certificate Of Incorporation (CoI). This certificate legalizes your company and includes its Company Identification Number (CIN).

9. Apply for PAN and TAN

Once you have the COI, apply for your company’s PAN and TAN. Your company needs these for tax management.

Good news: PAN and TAN applications are now part of SPICe+, so you generally get them with your COI.

10. Open a Bank Account and Start Operations

After getting the PAN, you can open a company current account at any bank.

Most banks require COI, PAN, MOA, AOA, and board approval to open accounts. You may officially start your Bangalore business after this!

List of Documents Required for Company Registration in Bangalore

Documents of Directors & Shareholders

- PAN Card of Directors

- Adhar Card of Directors

- Passport Sized Photo (Digital Copy)

- Electricity Bill (Address proof)

- Telephone Bill (Address Proof)

Proofs of Registered Office

- Electricity Bill/Property Tax Tickets

- No Objection Certificate from Owner

- Valid Rental Agreement (Notarized)

All papers' addresses must match the application address to avoid confusion or rejection during registration.

Additional Documents to Be Ready With

For a seamless Bangalore business registration, you must prepare more than the key data.

- These include the prospective company’s MOA and AOA.

- If directors apply, you must have their DIN and DSC available.

- The board of directors and owners may need to declare their legal obligations.

When these papers are ready, the registration procedure proceeds without delays or requests for extra information.

How Much is the Company Registration Cost in Bangalore?

Remember the charges of forming a company in Bangalore.

Knowing everything’s cost might help you budget and avoid surprises. The price varies by business structure, company size, and added services, but the procedure is often inexpensive and straightforward.

Understanding the primary fees of business registration is crucial before starting.

Government Fees for Business Registration

- Registering a business in Bangalore includes many government fees.

- These fees cover Ministry of Corporate Affairs (MCA) form filing fees, stamp duties based on approved capital, and DSC and DIN application fees.

- The exact amount depends on your business structure and cash flow.

- New enterprises and startups can start quickly since Private Limited enterprises or LLPs have reduced government fees.

Professional Fees of Company Registration in Bangalore

You should also consider the service provider’s company registration service fees for Bangalore, along with government fees.

These fees usually cover a lawyer’s consultation, document writing, form filing, and complete registration assistance. The cost depends on how complicated your firm is, how many owners you have, and any extra services you pick, such as GST registration or trademark filing.

A reliable service ensures uncomplicated paperwork, compliance, and faster approvals.

Company Registration At Affordable Cost

What Are The Post Registration Compliances Required for New Business?

GST Certificate

GST registration lets you collect customer taxes and earn input tax credits. Clients and partners trust GST-registered firms. A GST number is essential for any firm selling in the same or various states. It also boosts company professionalism.

Get GST Registration For Your Business Quickly!

Annual Filings

After registering the company in Bangalore, the MCA and other regulatory authorities require you to file specific documents annually.

Filings comprise annual reports on company operations and shareholders, tax returns, and financial statements.

Late filing of these records could lead to fines and legal problems. Annual filings keep your company in good standing with the government, ensure compliance with Indian law, and reassure partners.

Hiring an Auditor

When your company starts up, appoint an auditor to check its financial records and ensure you follow the rules within 30 days of registration.

Regular financial audits are required by law to help spot business issues early. Auditor hiring builds investor, stakeholder, and government trust, guaranteeing your business’s transparency.

Statutory Audits & Record Keeping

Depending on the size and income of a company, a trained auditor must review its financial records yearly. The audit guarantees that the company’s financial records are correct and by accounting standards.

The business must also keep accurate records of financial transactions, contracts, invoices, and receipts.

Why Choose Prashasthi Corporate Advisors For Company Formation Services in Bangalore?

Expert Guidance at Every Step

Prashasthi Corporate Advisors provides experienced assistance throughout company formation. As a group of leading company registration consultants, we provide straightforward, helpful advice that saves time and ensures your company is legally established.

Customized Solutions for Your Business Needs

We as company setup consultants tailor our options to your needs because every business is different. We'll assist you in choosing a Pvt Ltd, LLP, or other structure for your business plan and growth goals.

Transparent and Affordable Fees

Prashasthi believes prices should be transparent. When you form a company with us, you'll get the most for your money because our prices are fair and transparent.

Comprehensive Post-Registration Support

We assist you in registering your business and meeting compliance requirements like GST filing, annual reports, and audits. This all-around strategy keeps your firm lawful and running efficiently.

FAQs on Company Registration in Bangalore

Can I register a company online in Bangalore?

The Bangalore Ministry of Corporate Affairs (MCA) portal allows online company formation.

You should employ a business registration professional to guide you through the procedure and ensure you follow all the requirements.

What capital does a company need to register in Bangalore?

Following the Companies (Amendment) Act, 2015, a company can now establish itself in India without requiring minimum cash reserves.

A business organization can begin operations regardless of its capital.

Which business structure is best for startups in Bangalore?

A Private Limited Company is frequently the ideal option for new enterprises due to its low risk, ease of funding, and professional company appearance.

Your business’s goals and demands will determine its perfect structure.

Is GST registration mandatory after company incorporation?

To register for GST, your company must earn over ₹40 lakhs annually (₹10 lakhs in some states). No matter your revenue, you must register for GST if you sell products or services between states or online.